Sales Mix and Sales Mix Variance: Explanation, Formula, and Example

It tells the “what” but not the “why.” As a result, companies use the sales mix variance and other analytical data before making changes. For example, companies use profit margins (net income/sales) to compare the profitability of different products. For example, if a car company sells 100,000 low-profit cars and 400,000 medium-profit cars and 500,000 high-profit trucks, it has a sales mix of 10% + 40% + 50%. Contribution margins are the differences between sale prices and each product’s variable costs (e.g., materials or labor). Working this out helps businesses understand how different products or services contribute to overall profitability.

Contribution margin vs. sales mix contribution margin

The concept behind Sales Mix is to assess the changing of profit due to changing the Sales Mix Ratio. To calculate for a target profit, simply add the target profit to fixed costs and run the same calculations. This means for every $100 worth of wired speakers your company sells, it results in $75 of profit.

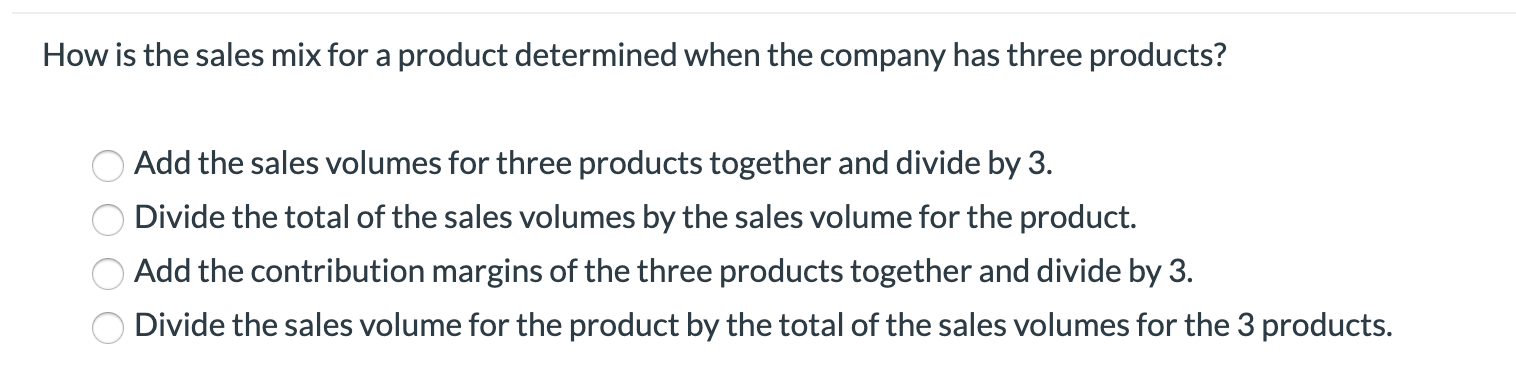

How to Calculate Sales Mix

Adverse sale mix variance suggests that a higher proportion of the low margin products were sold during the period than expected in the budget. Sales mix variance is adverse in this example because a lower proportion (i.e. 26%) of Turbox (which is more profitable than Speedo) were sold during the year as compared to the standard mix (i.e. 40%). Sales Mix Variance measures the change in profit or contribution attributable to the variation in the proportion of the different products from the standard mix. For example, you can use Pipedrive’s email marketing software to create carefully crafted campaigns that benefit your sales mix. You can also easily track their success with notifications alerting you to any engagement.

Sales mix contribution margin

Therefore, it needs to be monitored continuously, and it shall be altered from time to time by analyzing the individual product contribution. It’s worth noting that sales mix can also refer to the variety of products sold by a company (or the “mix” of “sales,” if you will), but for business purposes, we’re going to use the definition above. And the actual sales are 180,000 units, while the actual Sales Mix is Product A got 40%, and product B is 60%. Basically, the Sales Mix is the ratio of each product that contributed to the total sales.

How to Calculate Cost of Goods Sold in Your Business

Every company has limited time to create, market and sell products, so making smart decisions and focusing on the right products can make you more money. Learn how to use the sales revenue formula so you can gauge your company’s continued viability and forecast more accurately. It sounds complicated, but as we’ll see in the next section, the formula is quite simple. It’s keeping tabs on product changes and remembering to do the calculations that can get overwhelming and cause revenue losses. This means for every $100 worth of Bluetooth speakers your company sells, it contributes $67 to the bottom line.

Sales mix formulas: volume and revenue

Sales mix variance quantifies the effect of the variation in the proportion of different products sold during a period from the standard mix determined in the budget-setting process. Based on the budgeted sales mix and actual sales, A’s sales are under expectations by 200 units (1,200 budgeted units – 1,000 sold). However, B’s sales exceeded expectations by 200 units (1,800 budgeted units – 2,000 sold). From the sales mix, we can see that Product B generates the most sales revenue, but it has the lowest contribution margin.

- Companies review sales mix variances to identify which products and product lines are performing well and which ones are not.

- Sales mix is an important consideration in CVP analysis because it can significantly impact a company’s profitability.

- To improve your company’s sales mix, you need to understand sales mix variance.

- As a business, your biggest asset is detailed data about your products and customers.

But if it’s negative, you can also use that information to determine the next steps with your sales team or inventory planning team. The sales mix contribution margin is the amount of actual dollars a company sees from the sales mix percentage in a given time period. This metric is used to calculate the number of product units a company needs to sell in order to remain at its sales mix goal. Profit margin is defined as net income divided by sales, and this ratio is a useful tool to compare the relative profitability of two products with different retail sales prices. Assume, for example, XYZ Hardware generates a net income of $15 on a lawnmower that sells for $300 and sells a $10 hammer that produces a $2 profit. The profit margin on the hammer is 20%, or $2 divided by $10 while the mower only generates a 5% profit margin, $15 divided by $300.

Analysts and investors use a company’s sales mix to determine the company’s prospects for overall growth and profitability. If profits are flat or declining, the company can de-emphasize or even stop selling a low-profit product and focus on increasing sales of a high-profit product or service. If the company wants to increase the sales of Product A to achieve the target profit, it needs to sell an additional 333 units (1,333 units in total). On the other hand, if the company decides to increase the sales of Product B to achieve the target profit, it needs to sell an additional 125 units (625 units in total). Alternatively, the company can increase the sales of both products by selling an additional 187 units of Product A and 63 units of Product B. Sales Mix Variance is one of the two sub-variances of sales volume variance (the other being sales quantity variance).

Aliengear budgeted sales of 1,600 units of Turbox and 2,400 units of Speedo in the last year. The standard variable costs of a single unit of Turbox and Speedo were set at $1,500 and $750 respectively. Divide that by total units of 2,900 and we get a weighted average contribution margin of $1.50.

The $5,000 bicycle requires a higher investment and will also return a higher profit percentage than the lower cost bicycles. The breakeven point will washington d c tax preparation be based on the current sales and costs of the bikes. Let’s assume that an automobile company plans to sell 100,000 units in the current year.